Open API List

API Overview

The Smilepayz platform provides a comprehensive set of RESTful APIs for payment processing, transaction management, and account operations. These APIs enable seamless integration with various payment methods and support multiple regional markets.

Core API Endpoints

| No | API Name | Description |

|---|---|---|

| 1 | Pay-In API | Customer payment collection and processing Features: Multi-payment method support, real-time processing Use Case: E-commerce payments, service fees, donations |

| 2 | Pay-Out API | Fund disbursement to recipients Features: Bank transfers, digital wallet payments Use Case: Refunds, payroll, vendor payments |

| 3 | Inquiry Status API | Transaction status verification and monitoring Features: Real-time status updates, comprehensive transaction details Use Case: Order tracking, payment confirmation |

| 4 | Inquiry Balance API | Account balance checking and verification Features: Multi-account support, real-time balance information Use Case: Balance verification, financial reporting |

API Categories

Transaction Processing APIs

APIs for handling financial transactions including payment collection and fund disbursement.

Inquiry & Monitoring APIs

APIs for checking transaction status, account balances, and system health monitoring.

Detailed API Descriptions

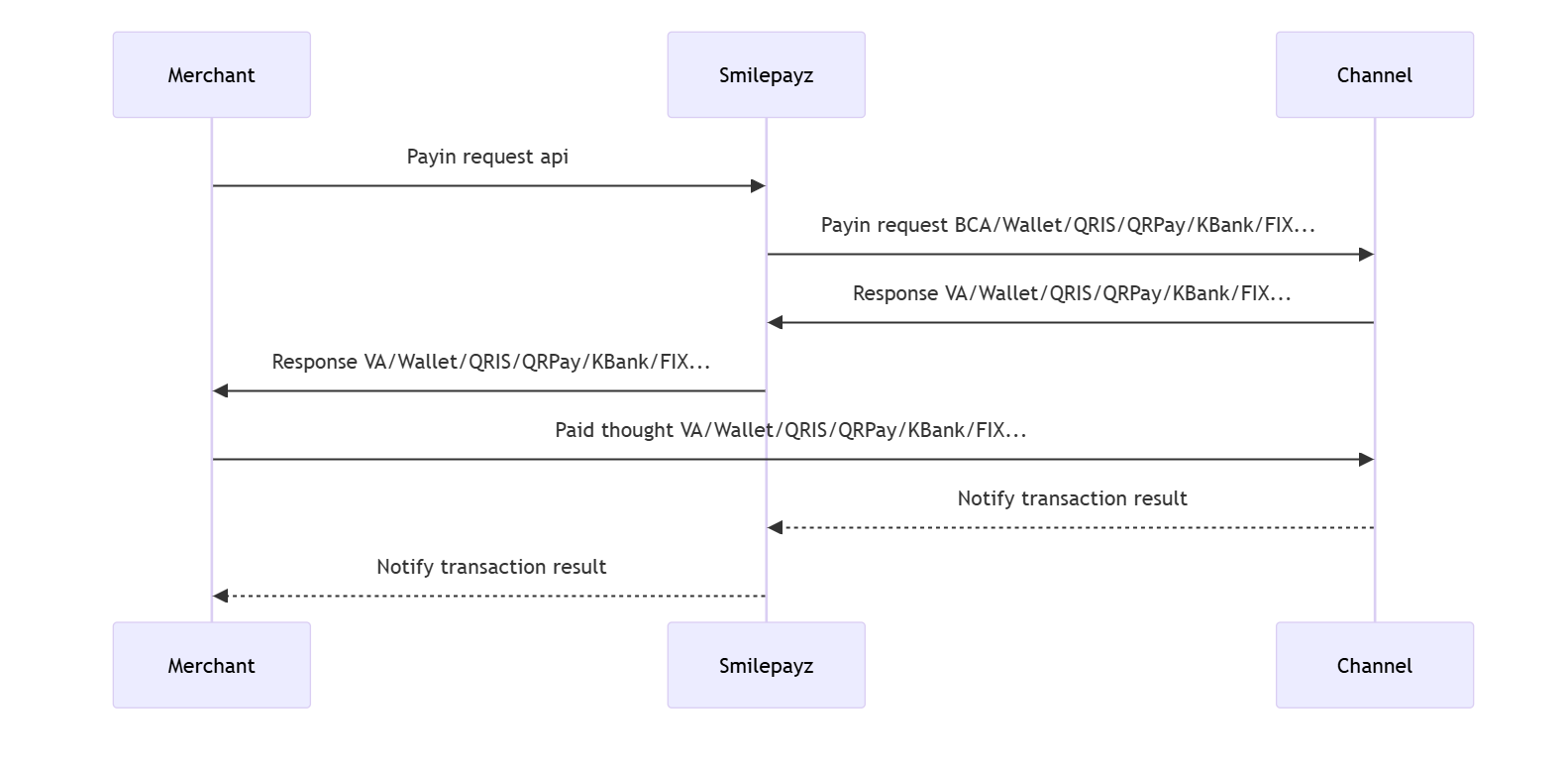

Pay-In API

The Pay-In API facilitates customer payment collection across multiple payment methods and regions. This API supports various payment channels including digital wallets, bank transfers, QR payments, and cash payments.

Key Features

- Multi-Payment Method Support: QRIS, UPI, PIX, SPEI, and more

- Real-Time Processing: Immediate payment confirmation

- Regional Compliance: Adherence to local payment regulations

- Webhook Integration: Asynchronous payment notifications

Use Cases

- E-commerce Payments: Online store payment processing

- Service Fees: Subscription and recurring payments

- Donations: Charitable contribution collection

- Event Tickets: Event and transportation ticket sales

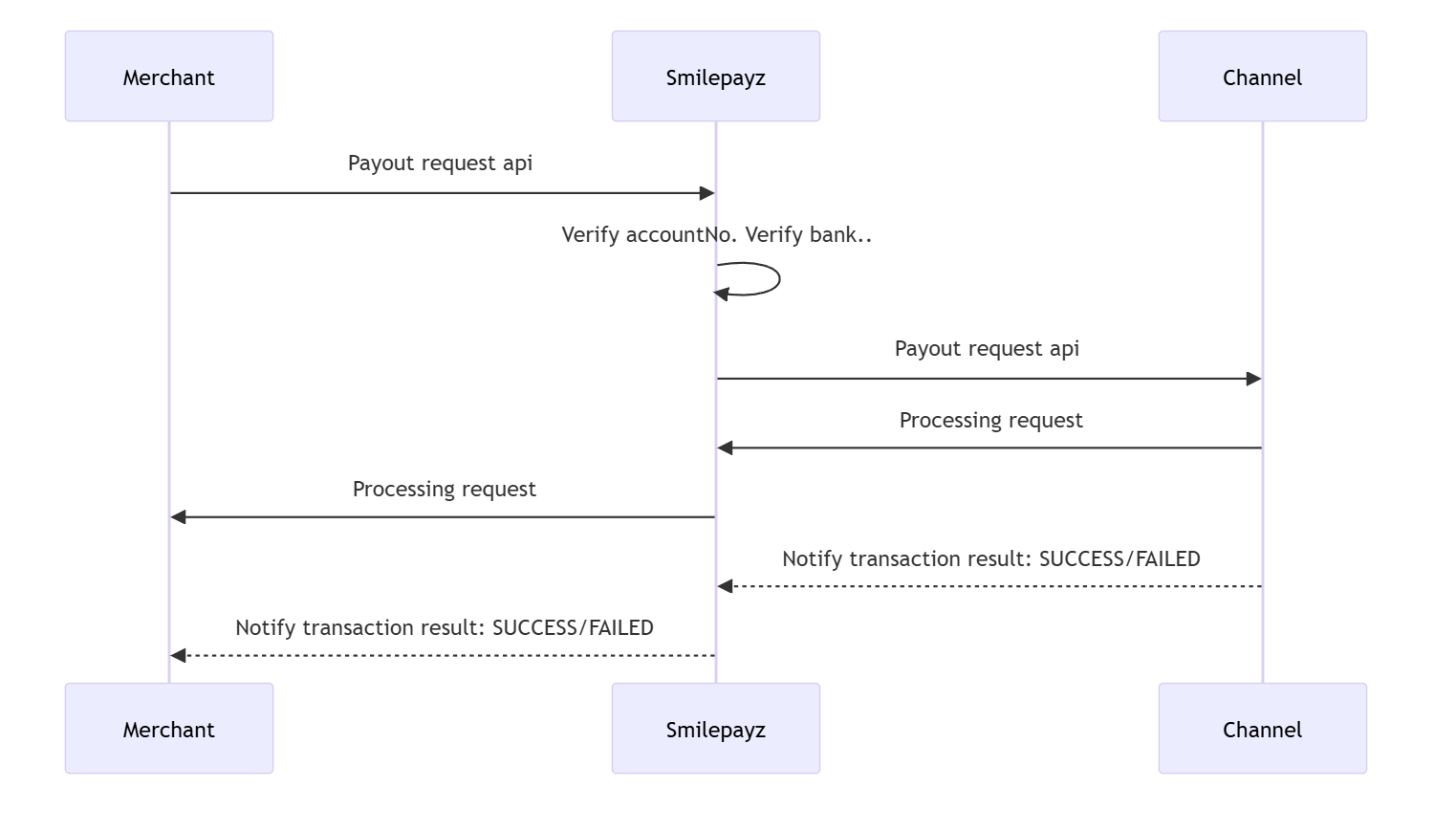

Pay-Out API

The Pay-Out API enables secure fund disbursement to recipients through various channels. This API supports bank transfers, digital wallet payments, and cryptocurrency transactions.

Key Features

- Multi-Channel Disbursement: Bank transfers, digital wallets, crypto

- Recipient Verification: Enhanced KYC and identity verification

- Batch Processing: Efficient handling of multiple disbursements

- Compliance Management: Regulatory compliance and reporting

Use Cases

- Refund Processing: Customer refund disbursement

- Payroll Management: Employee salary payments

- Vendor Payments: Supplier and contractor payments

- Cash Withdrawals: Merchant account withdrawals

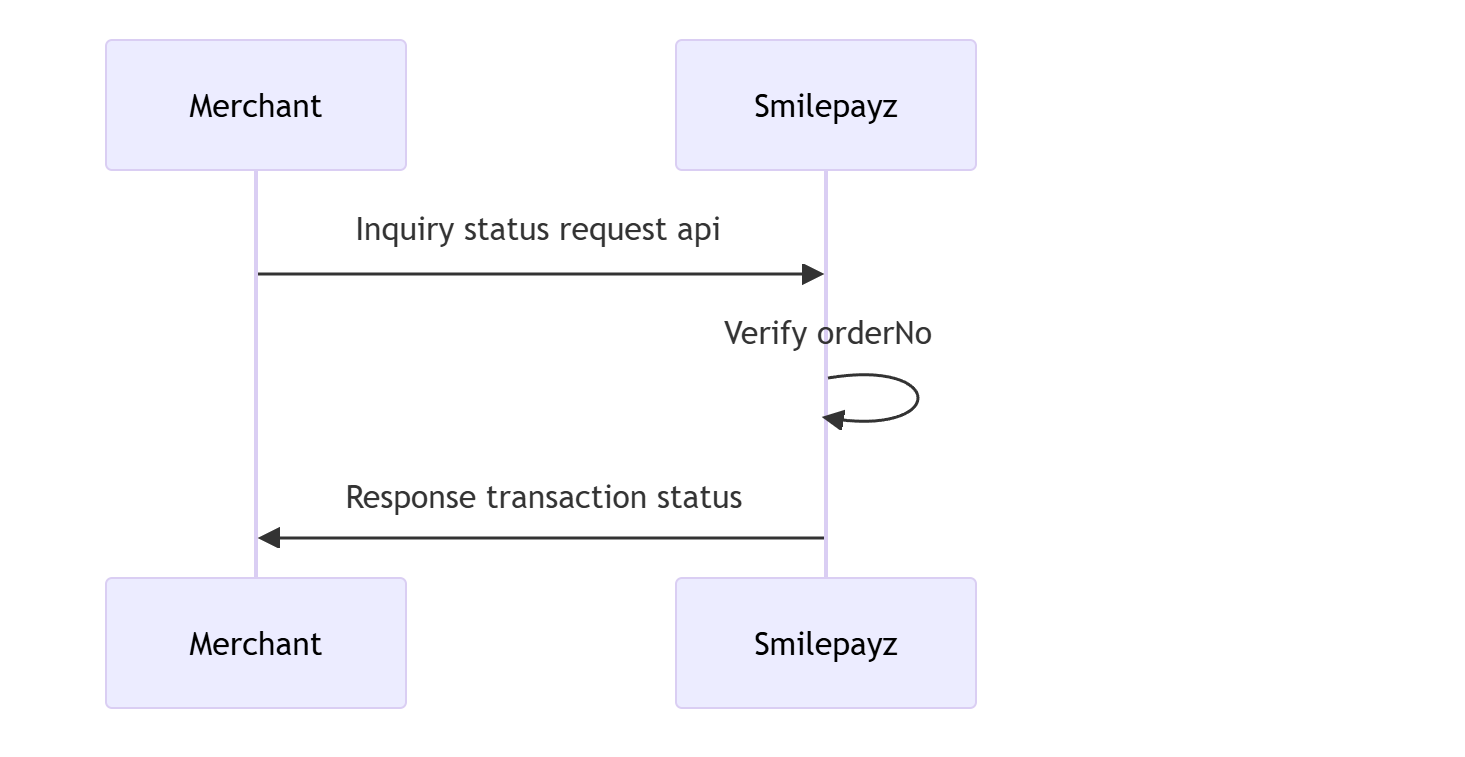

Inquiry Status API

The Inquiry Status API provides comprehensive transaction status information and monitoring capabilities. This API enables real-time tracking of payment transactions and status updates.

Key Features

- Real-Time Status: Live transaction status updates

- Comprehensive Details: Complete transaction information

- Multi-Status Support: All transaction lifecycle states

- Audit Trail: Complete transaction history

Use Cases

- Order Tracking: Customer order status monitoring

- Payment Confirmation: Transaction completion verification

- Dispute Resolution: Transaction investigation and support

- Reporting: Transaction status reporting and analytics

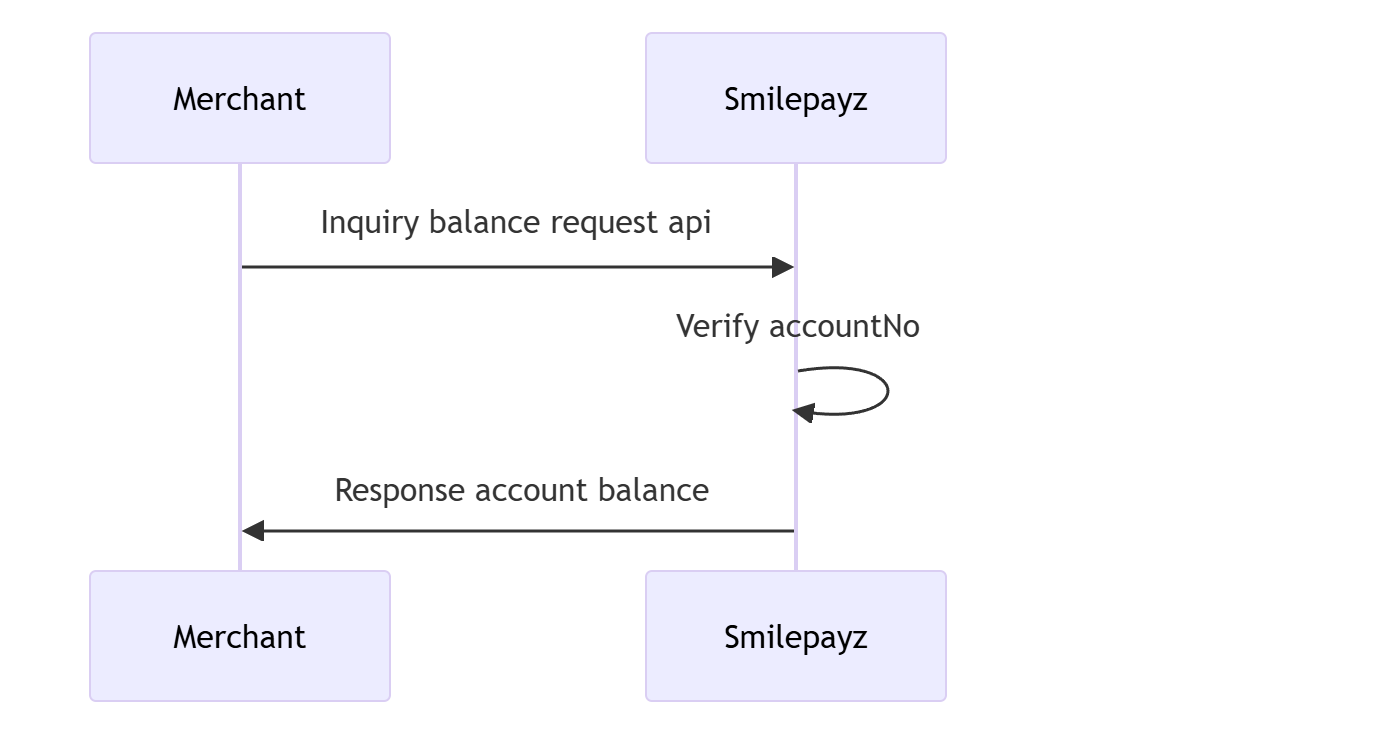

Inquiry Balance API

The Inquiry Balance API provides account balance information and financial status monitoring. This API supports multiple account types and real-time balance checking.

Key Features

- Multi-Account Support: Pay-in and pay-out account balances

- Real-Time Information: Live balance updates

- Currency Support: Multi-currency balance checking

- Detailed Reporting: Comprehensive balance information

Use Cases

- Balance Verification: Account balance checking

- Financial Reporting: Balance reporting and analytics

- Risk Management: Balance monitoring for risk control

- Settlement Planning: Settlement amount verification

API Integration Guidelines

Authentication

- Digital Signatures: SHA256withRSA signature authentication

- Timestamp Validation: ISO 8601 timestamp with ±5 minute tolerance

- Merchant Credentials: Secure merchant ID and secret management

Request Format

- Content-Type: application/json

- Encoding: UTF-8 character encoding

- Timestamp: ISO 8601 format with timezone offset

Response Handling

- Status Codes: Standard HTTP status codes

- Error Handling: Comprehensive error code system

- Webhook Integration: Asynchronous notification support

Security Considerations

- HTTPS Only: All API communications over HTTPS

- Rate Limiting: API call frequency restrictions

- Data Encryption: Sensitive data encryption in transit

- Audit Logging: Complete API call logging and monitoring

Development Resources

SDK Support

- Multiple Languages: Java, Python, Node.js, PHP, C#, Golang

- Code Examples: Complete implementation examples

- Documentation: Comprehensive API documentation

- Testing Tools: Sandbox environment for testing

Support and Maintenance

- Technical Support: 24/7 technical support availability

- Documentation Updates: Regular API documentation updates

- Version Management: Backward compatibility and versioning

- Performance Monitoring: API performance and availability monitoring