Chile API Introduction

About 2 min

Environment Configuration

| Environment | Protocol | MediaType | Base URL |

|---|---|---|---|

| SandBox | https | application/json | https://sandbox-gateway.smilepayz.com |

| Production | https | application/json | https://gateway.smilepayz.com |

Chile Market Overview

Chile represents one of Latin America's most advanced digital payment ecosystems, characterized by high banking penetration, innovative fintech solutions, and a rapidly growing e-commerce sector. Our comprehensive API suite is specifically designed to address the unique requirements of the Chilean market.

Key Market Characteristics

- High Banking Penetration: Chile boasts one of the highest banking penetration rates in Latin America, with over 80% of adults having access to formal financial services

- Diverse Payment Methods: Support for major Chilean banks including Banco Estado, Banco de Chile, Banco Santander, and other leading financial institutions

- Cash Payment Integration: Traditional cash payment methods remain popular, supported through our CASHIER_CL system

- Robust Identity Verification: Comprehensive support for Chilean identity documents including RUT, DNI, CE, and PAS

- Real-Time Processing: Advanced payment processing capabilities with immediate transaction confirmation

- Regulatory Compliance: Full compliance with Chilean financial regulations and Central Bank requirements

Supported Payment Solutions

- Bank Transfers: Direct integration with major Chilean banks for secure and efficient fund transfers

- Cash Payments: Traditional cash payment collection through authorized payment centers

- Digital Wallets: Integration with emerging digital payment platforms

- Cross-Border Transactions: Support for international payment processing

- Real-Time Settlement: Immediate transaction processing and settlement capabilities

API Features

- Multi-Bank Support: Seamless integration with Chile's leading banking institutions

- Identity Verification: Comprehensive support for Chilean identity document types

- Account Type Flexibility: Support for both current (CORRIENTE) and savings (AHORROS) accounts

- Local Currency Processing: Native support for Chilean Peso (CLP) transactions

- Timezone Optimization: All timestamps optimized for Chile's UTC-3 timezone

- Security Standards: Bank-grade security with RSA digital signatures and encryption

Development Resources

GitHub Code Examples

PayInRequestDemo.java- Complete pay-in transaction implementationPayoutRequestDemo.java- Comprehensive pay-out transaction processingInquiryBalanceDemo.java- Real-time account balance inquiryInquiryOrderStatusDemo.java- Transaction status monitoringSignatureUtils.java- Digital signature utilities including minify(body), sha256RsaSignature, and checkSha256RsaSignature methods

pay_in_request_demo.py- Pay-in transaction implementationpay_out_request_demo.py- Pay-out transaction processingbalance_inquiry.py- Account balance inquiry functionalitystatus_inquiry.py- Transaction status monitoringTool_Sign.py- Digital signature utilities with minify(body), sha256RsaSignature, and checkSha256RsaSignature methods

pay_in_request_demo.js- Pay-in transaction implementationpay_out_request_demo.js- Pay-out transaction processinginquiry_balance_demo.js- Account balance inquiry functionalityinquiry_order_status.js- Transaction status monitoringSignatureUtils.js- Digital signature utilities with minify(body), sha256RsaSignature, and checkSha256RsaSignature methods

PayInRequestDemo.php- Pay-in transaction implementationPayoutRequestDemo.php- Pay-out transaction processingInquiryBalanceDemo.php- Account balance inquiry functionalityInquiryOrderStatusDemo.php- Transaction status monitoringSignature.php- Digital signature utilities with minify(body), sha256RsaSignature, and checkSha256RsaSignature methods

PayInRequestDemo.cs- Pay-in transaction implementationPayOutRequestDemo.cs- Pay-out transaction processingBalanceInquiryDemo.cs- Account balance inquiry functionalityOrderStatusInquiryDemo.cs- Transaction status monitoringSignatureUtils.cs- Digital signature utilities with minify(body), sha256RsaSignature, and checkSha256RsaSignature methods

/v2/PayInRequestDemoV2.go- Pay-in transaction implementation/v2/PayoutRequestDemov2.go- Pay-out transaction processing/v2/BalanceInquiryDemoV2.go- Account balance inquiry functionality/v2/OrderStatusInquiryDemoV2.go- Transaction status monitoring/common/SignatureUtils.go- Digital signature utilities with minify(body), sha256RsaSignature, and checkSha256RsaSignature methods

The current document version is above 1.0.5 (including 1.0.5). Please download 1.0.5 and install it before payment

Installation Guide

WooCommerce Plugin Installation

- Plugin Discovery: Search for the plugin in the WordPress plugin directory

- Installation: Click "Install Now" to begin the installation process

- Activation: Activate the plugin after successful installation

- Manual Upload: Alternatively, use the "Upload Plugin" option at the top of the page

- File Selection: Click "Choose File" and locate the plugin file

- Completion: Click "Activate Plugin" after installation is complete

Configuration Setup

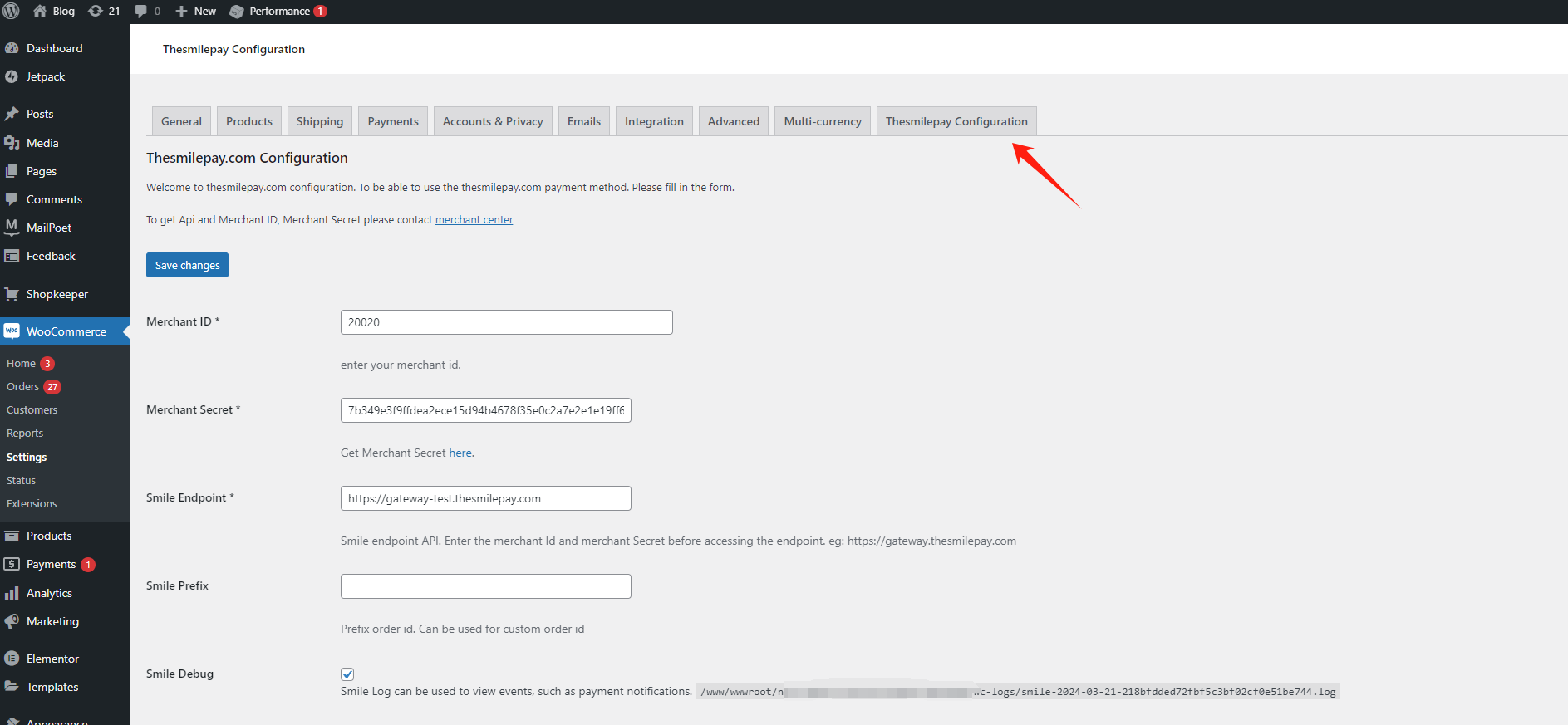

Step 1: Merchant Configuration

Configure your merchant credentials including MerchantID and MerchantSecret

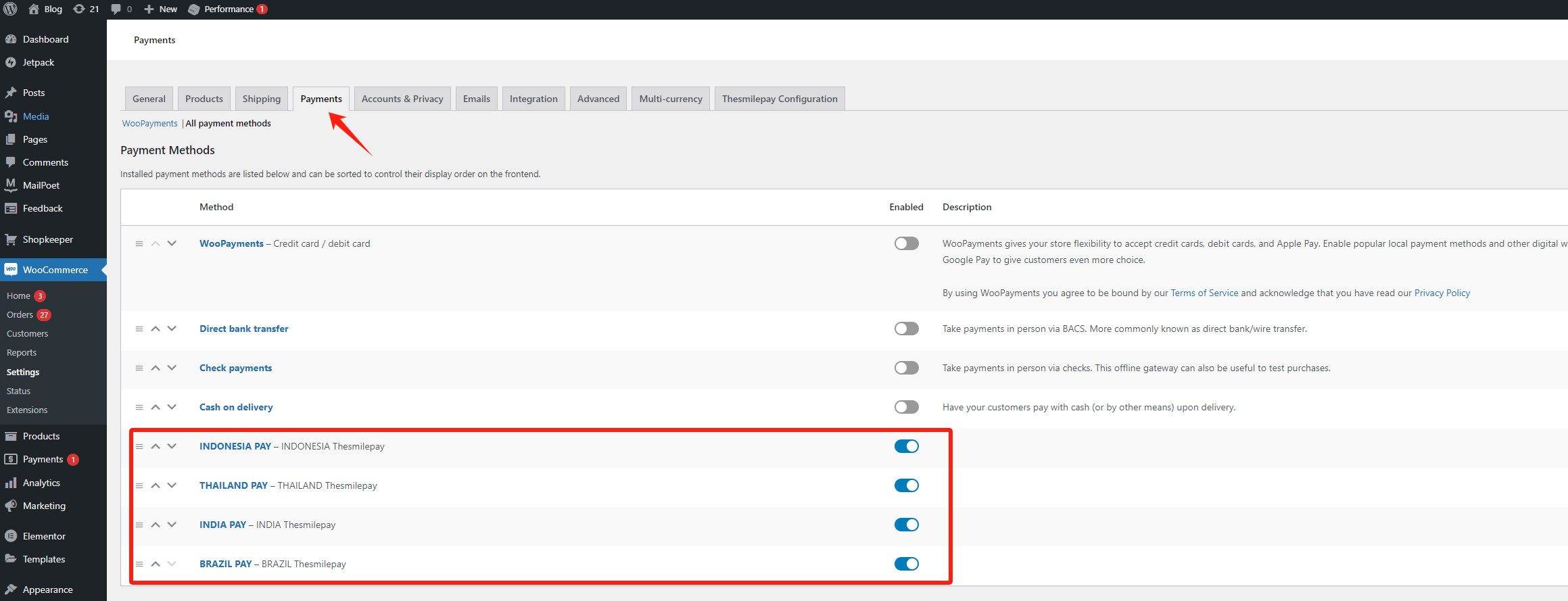

Step 2: Payment Method Activation

Enable the desired payment methods for your store